On the 6th, major indexes on the New York Stock Exchange fell together

Nasdaq General·Philadelphia Semiconductor -2%

Postponing the release of ‘Apple Car’ until 2026

Reduce market expectations Apple stock price 2.5% ↓

JP Morgan CEO: “Inflation is eating into the economy”

Goldman ‘lower consumption capacity also a problem’

International oil price 4% ↓… below $80

※ For more information, see you on Telegram and YouTube ‘Wolga-Wolbu’! ※

As the heads of Wall Street’s major investment banks warned of an economic recession next year, the US stock market closed again.I did it. While China’s zero (0) corona quarantine policy is partially easing, the Chinese stock market soars, while in the United States, in addition to the possibility that the US central bank Federal Reserve will raise the benchmark interest rate for longer period, recession warnings come out one after another The New York stock market is shaking.

December is usually in the middle of the Santa Claus Rally, but as market volatility increases, the results of the Federal Open Market Committee’s (FOMC) regular meeting hosted by the Federal Reserve next week It’s worth watching.

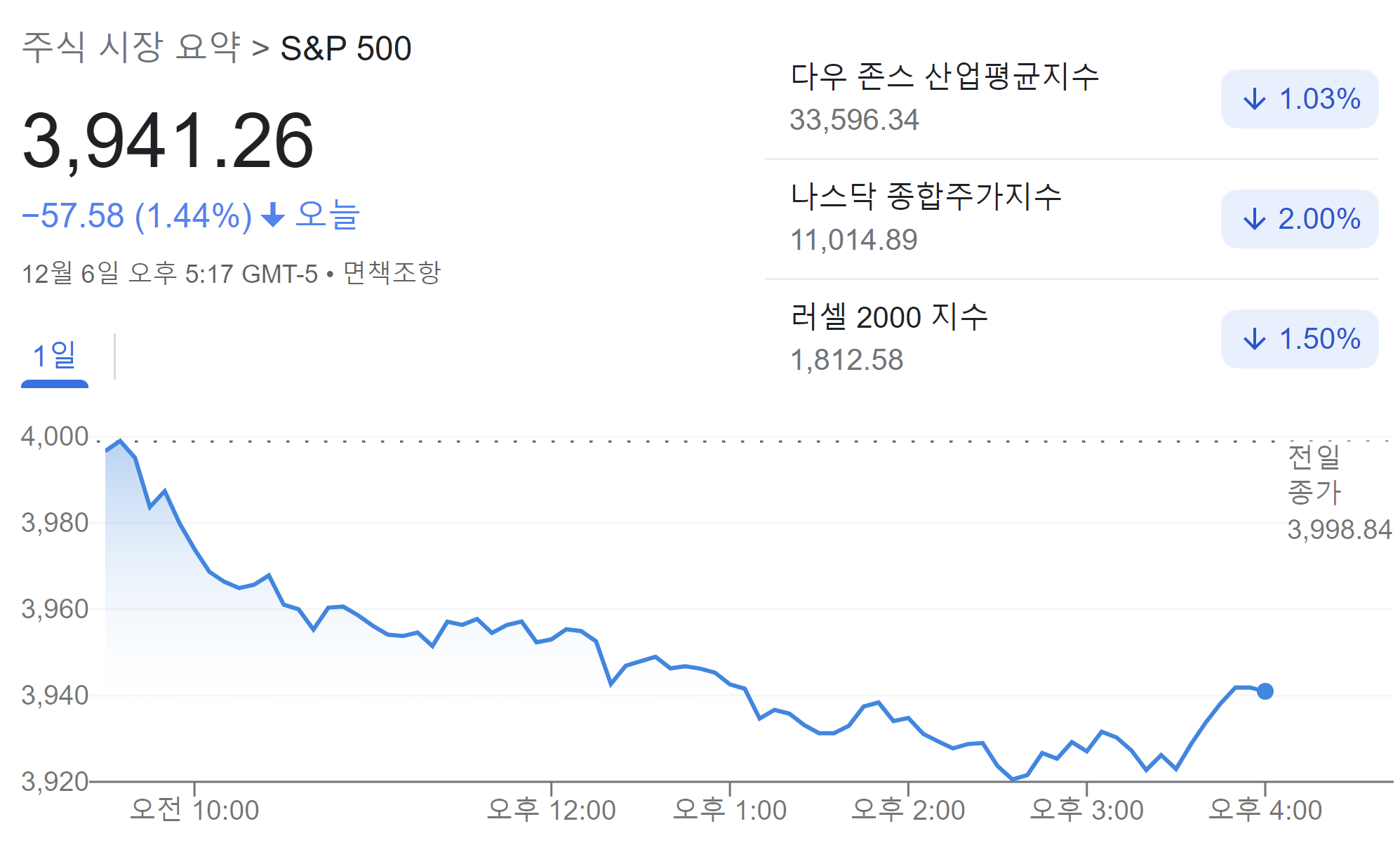

On the 6th (hereafter referred to as US Eastern time), the four major stock indexes fell together on the New York Stock Exchange.I did it. The Standard & Poor’s (S&P) 500 stock index and the Dow Jones 30 industrial average index, which focuses on large-cap stocks, fell 1.44% and 1.03%, respectively, from the previous day. The Nasdaq Composite Stock Index, which focuses on technology stocks, and the Philadelphia Semiconductor Index, which includes major semiconductor stocks, fell 2.00% and 2.36%, respectively. The small-cap and mid-cap Russell 2000 Index fell 1.50%. By sector, most sectors struggled with the exception of the utilities sector.

the same day The volatility index increasedI did it. The Chicago Options Exchange Volatility Index (VIX), known as the ‘New York Stock Exchange Fear Index’, jumped around 7% on the same day to 22.17.

By individual stock, the stock price of Apple, which has the largest market cap, fell 2.54% on the same day.It ended the year trading at $142.91 per share. Investor sentiment has also been affected, but Sales trend as news breaks that Apple is taking a step back from its plan to launch an ambitious self-driving electric caris a result of an increase in

On this day, Bloomberg reported, citing an unnamed official, that Apple scaled back its self-driving car development plan and pushed back the target date for the launch of electric vehicles by a year to 2026. Previously, in early 2021, rumors circulated that Apple would collaborate with Hyundai Motor Company in Korea to produce an autonomous electric vehicle (Apple Car), and at one time, Apple and related stocks were popular in the Korean stock market.

Analysis followed that Ian Goodfellow, developer of artificial intelligence (AI), a vital technology for self-driving, left the company to protest Apple’s ‘end telecommuting and return to the office’ policy, and there was a setback in technology. development. However, in addition to this, it is an environment where it can be demanding to enter the electric vehicle market in a hurry, such as recent reports that Tesla may reduce production due to concerns about slowing demand for electric vehicles in China, which is the largest electricity. vehicle market’.

Tesla stock priceThe stock also fell 1.44% to close at $179.82 on the day. As the possibility of a global economic downturn, including China, grows, the problem of slowing demand is a stumbling block.It works as In particular, China has been implementing a policy of using Chinese-made electric vehicles at the leadership level of the Communist Party for several years.

On Wall Street on the same day, CEOs of major investment banks warned of an economic downturn.presented in succession. America’s biggest bank known as the ‘King of Wall Street’ Jamie Dimon, CEO of JP Morgan Chase In an interview with CNBC that day, “Inflation eats everything“During the COVID-19 pandemic, the amount of excess savings that American households have received from the government is worth $1.5 trillion, which will expire by the middle of next year,” he said.

“The Fed is raising interest rates quickly, but it may not be enough to control inflation,” he said.Because of rising prices, when people draw on their savings, the economy can stall, and a recession, whether mild or severe, is likely. “point out.

Another major investment bank Goldman Sachs CEO David SolomonIn an interview with the local media on the same day, “In the future, Financial resources should be handled more carefully as they can fall into difficult times” he warned. This is based on the assumption that the Fed’s interest rate hike will cool the job market and reduce workers’ wages, further reducing people’s spending power. CEO Solomon also said, “We expect a slowdown in US economic growth. We could face a recession by 2023” I predicted.

Brian Moynihan, CEO of Bank of America, also said, “Consumers are spending a lot now, but consumer spending growth is slowing.

Meanwhile, in the bond market, major US Treasury yields closed lower across the board.I did it. The yield on three-month Treasury bonds, a typical short-term yield, closed at 4.37%, up 1bp (=0.01%p) from the previous day. However, the yield on the two-year Treasury bond, which is sensitive to the benchmark interest rate, fell 4bp to 4.73%, and the yield on the US 10-year Treasury bond, which acts as a guide for long-term interest rates in the market, closed at 3.51%, down 9bp.

On the same day, the US dollar rose in the New York foreign exchange market.I did it. The Dollar Index, which shows the value of the US dollar against six major currencies, rose 0.25% to 105.55 as of 5:28 pm on the same day.

In the energy market, international oil prices have fallen to their lowest level this year due to the pressure of economic stagnation in many places, including the United States. He fell. On the New York Mercantile Exchange, the United States West Texas January oil contract fell 3.48% from the previous day to $74.25 a barrel, and on the London ICE Exchange, the price of February Brent oil fell 4.03% to $79.35.

This is the second time this year that Brent has fallen below $80 a barrel, and the one-day drop was the biggest since last September. Meanwhile About WTI Eli Tesfaye, chief market strategist at RJO Futures, said: “At this rate, WTI It could drop to the $60 mark.”“Even if major oil producing countries maintain production cuts and China begins a partial economic restart, the crude oil market is too volatile at the moment,” he said.